Apple Inc. (AAPL) is one of the world's most recognizable and successful technology companies, with a market capitalization of over $2 trillion. As a leading player in the tech industry, Apple's stock price is closely watched by investors, analysts, and enthusiasts alike. In this article, we will provide an overview of Apple's stock price, news, and analysis, helping you make informed investment decisions.

Current Stock Price and Performance

As of the latest market update, Apple's stock price is trading at around $150 per share, with a 52-week range of $102.08 to $182.94. The company's market capitalization stands at approximately $2.3 trillion, making it one of the largest publicly traded companies in the world. Apple's stock has consistently outperformed the broader market, with a 5-year return of over 200%.

Recent News and Developments

Apple has been in the news recently for several significant developments, including:

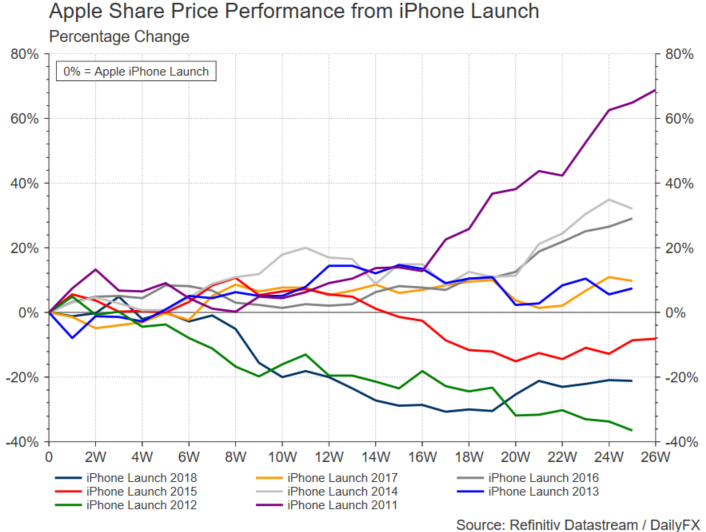

The launch of the iPhone 13 series, which has seen strong demand and positive reviews from critics and consumers alike.

The company's

announcement of a $90 billion share buyback program, aimed at returning value to shareholders.

Apple's

expansion into new markets, including healthcare, finance, and automotive, through strategic partnerships and acquisitions.

Analysis and Trends

Analysts remain bullish on Apple's prospects, citing the company's:

Strong brand loyalty: Apple's loyal customer base and ecosystem of products and services provide a significant competitive advantage.

Innovative product pipeline: Apple's commitment to research and development ensures a steady stream of innovative products and services.

Growing services segment: Apple's services business, including Apple Music, Apple TV+, and Apple Arcade, is expected to continue driving growth and profitability.

However, some analysts also note potential risks and challenges, including:

Intense competition: The tech industry is highly competitive, with companies like Samsung, Google, and Amazon vying for market share.

Regulatory scrutiny: Apple faces regulatory challenges, particularly in the areas of antitrust and data privacy.

Global economic uncertainty: Economic downturns and trade tensions can impact consumer spending and Apple's global supply chain.

Apple's stock price, news, and analysis suggest a company that is well-positioned for long-term growth and success. While there are potential risks and challenges, Apple's strong brand, innovative products, and growing services segment make it an attractive investment opportunity. As with any investment, it's essential to conduct thorough research and consider your individual financial goals and risk tolerance before making a decision.

For the latest Apple stock price, news, and analysis, visit

MarketBeat for up-to-date information and insights.

Note: This article is for informational purposes only and should not be considered as investment advice. Always consult with a financial advisor before making investment decisions.

![Why I'm buying Apple Stock [$AAPL] - YouTube](https://i.ytimg.com/vi/ohmnN5L5yKk/maxresdefault.jpg)